Investors

Opportunity Zones 1.0 (Original, Temporary Tax Incentive)

Qualified Opportunity Zones were created by the 2017 Tax Cuts and Jobs Act. These zones are designed to spur economic development and job creation in distressed communities throughout all 50 States, the District of Columbia, and the five U.S. territories by providing tax benefits to investors who invest eligible capital into these communities. This is now known as OZ 1.0.

An Opportunity Zone is generally an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualified as Opportunity Zones if they were nominated by their Governor for that designation by the State or Territory and that nomination was certified by the U.S. Secretary of the Treasury via his delegation of that authority to the Internal Revenue Service. With OZ 1.0, there are 8,764 Opportunity Zones in the United States, many of which have experienced a lack of investment for decades. The Opportunity Zone tax incentive has spurred capital investment and economic development in low-income communities.

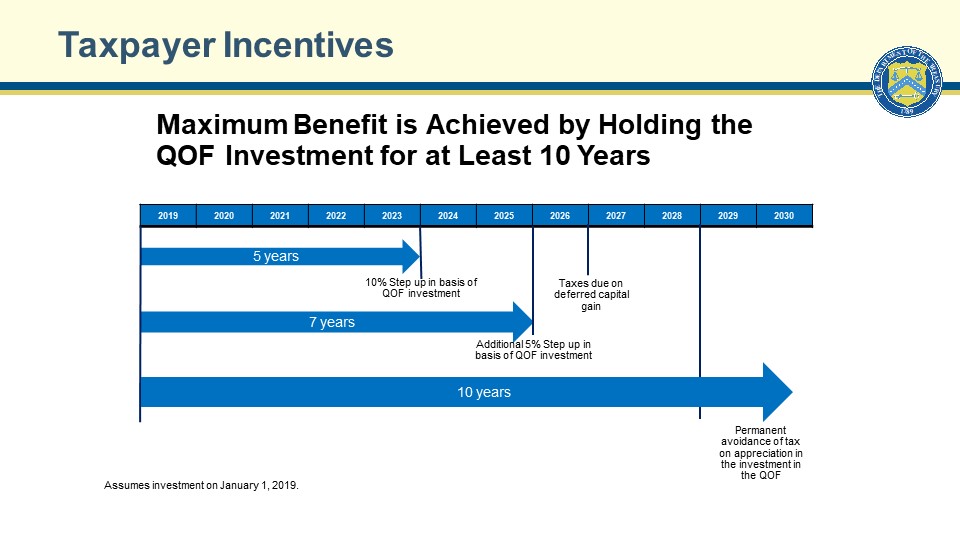

Under OZ 1.0 there are three key tax benefits. First, investors can defer the taxation of certain prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026. Second, if the QOF investment is held for at least 5 years, (only if invested by December 31, 2021), 10% of the gain that was originally deferred is eliminated completely. If the QOF investment is held for at least 7 years (only if invested by December 31, 2021), an additional 5% (15% total) of the original deferred gain is eliminated completely. This is known as “Step-Up in Basis.” This tax benefit for QOF investments has expired. Third, if the investor holds the QOF investment at least ten years, when the investor sells or exchanges the investment, the investor is eligible to eliminate the gain on the QOF investment from any increase in value of the QOF investment during the investor’s holding period.

Opportunity Zones 2.0 (Permanent, Tax Incentive)

On July 4, 2025, The One Big Beautiful Bill (The OBB) became law and with it a new, permanent Opportunity Zones tax incentive was created that was built from the original, OZ 1.0, tax incentive. This is known as OZ 2.0. It includes the same three key tax benefits as OZ 1.0 but with enhancements to streamline the structure of the OZ tax incentive to provide certainty and neutrality to QOF investors: step-up in basis, tax exclusion, and tax deferral.

Decennial redesignation cycles that will enable governors to refresh their map according to current and changing economic conditions on a predictable 10-year schedule. OZ 2.0 tightens the selection criteria for Governor nominated OZ census tracts from when the first set of OZ 1.0 census tracts were nominated, certified, and designated.

OZ 2.0 also created a new form of a QOF known as a “Qualified Rural Opportunity Fund” (QROF). Investors that invest in a QROF and QROF that hold 905 of its assets in qualified OZ property which is a is a QOZ Business (QOZB) property all of use of which was in an OZ comprised entirely of a “rural area”; or is a QOZ Stock (QOZS) or QOZ Partnership Interest (QOZPI) all of which all of the tangible property owned or leased is QOZB property and substantially all the use of which is in an OZ comprised entirely of a “rural area” will receive the enhanced OZ 2.0 tax benefits. The additional incentives for QROF investment in rural areas are: 30% step-up in basis and a 50% substantial improvement threshold. Note that the later benefit became effective on July 4, 2025. The OBB includes a specific definition for a “Rural Area”.

OZ 2.0 also includes enhanced investor reporting requirements with stronger compliance and enforcement regulations. The U.S. Department of the Treasury will be required to publish an annual report summarizing the data along with providing more comprehensive reports in the 6th and 11th calendar years following enhancement of the law.

Both the 2017 Tax Cuts and Jobs Act (OZ 1.0) and The One Big Beautiful Bill (OZ 2.0) provide the guidance for the creation of Qualified Opportunity Fund (QOF).

Click here to view the legislative language creating Opportunity Zones (OZ 1.0).

Once available, the legislative language for permanency of Opportunity Zones (OZ 2.0) will be posted here.

Under the OZ 1.0 regulations, to qualify for deferral:

Capital gains (short-term or long-term) must be invested in a Qualified Opportunity Fund (QOF) within 180 days.

Taxpayer elects deferral on IRS Form 8949 and files with its tax return.

Investment in the QOF must be an equity interest, not a debt interest.

| OZ 1.0 Investment Length | OZ 1.0 Benefits Received |

| Fewer than 5 years | Deferred tax payment on original capital gains until December 31, 2026 or the date that the QOF investment is sold or exchanged (whichever date is earlier) |

| 5-7 years | Deferred tax payment on original capital gains until December 31, 2026 or the date that the QOF investment is sold or exchanged (whichever date is earlier) AND 10% reduction in the amount of the original capital gains when the deferral ends and they are subject to tax (Step-Up in Basis). The 10% step-up in basis is no longer available to investors in a QOF. |

| 7-10 years | Deferred tax payment on original capital gains until December 31, 2026 or the date that the QOF investment is sold or exchanged (whichever date is earlier); AND an additional 5% reduction (total of 15%) in the amount of the original capital gains when the deferral ends and they are subject to tax. The additional 5% step-up in basis is no longer available to investors in a QOF. |

| Greater than 10 years | Permanent tax exclusion of the appreciation in the QOF investment (the initial value of which was the amount of the original capital gains, which were deferred). |

If a taxpayer holds its QOF investment for at least five years (prior to December 31, 2026), the taxpayer may exclude 10% of the original deferred gain from being taxed. If a taxpayer holds its QOF investment for at least seven years (prior to December 31, 2026), the taxpayer may exclude an additional 5% of the original deferred gain (for a total exclusion of 15% of the original deferred gain) from being taxed. This is known as a “Step-Up in Basis”. The original deferred gain – less the amount excluded due to the five- and seven-year holding periods – is recognized on the earlier of sale or exchange of the investment, or December 31, 2026. For OZ 1.0, the Step-Up in Basis tax benefit is no longer available. If the taxpayer holds the investment in the QOF for at least 10 years, the taxpayer may elect to increase its basis of the QOF investment to be equal to its fair market value on the date that the QOF investment is sold or exchanged. This may eliminate tax on appreciation on the QOF investment (IRS Tax Tips).

Under the OZ 2.0 statutory language to be incorporated into regulations, to qualify for deferral:

- Capital gains (short-term or long-term) must be invested in a Qualified Opportunity Fund (QOF) within 180 days.

- Taxpayer elects deferral on IRS Form 8949 and files with its tax return.

- Investment in the QOF must be an equity interest, not a debt interest.

| OZ 2.0 Investment Length | OZ 2.0 Benefits Received |

| Fewer than 5 years | Deferred tax payment on original capital gains to the date that the QOF investment is sold or exchanged |

| 5 or more years | Deferred tax payment on original capital gains until the date that the QOF investment is sold or exchanged AND 10% reduction in the amount of the original capital gains when the deferral ends and they are subject to tax (Step-Up in Basis). If Qualified Rural Opportunity Fund (QROF) investment in a rural area designated Opportunity Zone 30% reduction in the amount of the original capital gains when the deferral ends and they are subject to tax (Rural Area OZ Step-Up in Basis). |

| Greater than 10 years | Permanent tax exclusion of the appreciation in the QOF investment (the initial value of which was the amount of the original capital gains, which were deferred) |

OZ 1.0 Taxpayer Incentives

In June 2019, an individual investor in the highest tax bracket sells 1,000 shares of XYZ stock that the individual purchased in 2013 for $250,000. The sale at $1,250 per share results in a $1 million capital gain. Instead of paying the $238,000 in Federal income tax on this sale, the individual invests $1 million into a QOF within 180 days. The investment in the QOF must be an equity investment. The QOF invests the capital in newly issued preferred stock shares of various operating businesses located in Opportunity Zones. The individual plans to sell the QOF in 2030. The value of this investment in 2030 is $2.5 million. The benefits received by this investor include:

Investing $1 million instead of paying $238,000 in Federal income tax.

Paying taxes on $850,000 of gains in 2026 instead of paying $238,000 on $1 million in gains in 2019.

Owing no additional tax on the $1.5 million in gains on the QOF investment realized in 2030.

To qualify for the investor benefits described above, a QOF must:

Be organized as a corporation or partnership for the purpose of investing in Qualified Opportunity Zone property, and file IRS Form 8996 with its tax return.

Hold at least 90% of its assets in Qualified Opportunity Zone property. (Qualified Opportunity Zone property includes newly issued stock, partnership interests, or business property in a Qualified Opportunity Zone business).

There are additional requirements for Qualified Opportunity Zone Businesses and qualifications for Qualified Opportunity Zone Business Property that must be met under the statute and regulations.

Final Opportunity Zones 1.0 Rules from the Internal Revenue Service

On July 15, 2019, the Securities and Exchange Commission (SEC) together with their regulatory colleagues at the North American Securities Administrators Association (NASAA), staff issued a statement explaining the potential application of state and federal securities laws to fundraising for Opportunity Zones. Separately, their staff also provided guidance regarding the ability of Main Street investors to participate in these offerings.

The Opportunity Zone staff statement and guidance demonstrate that Main Street investors can invest in their communities in a manner that is compliant with SEC securities laws. Opportunity Zones provide a community-specific incentive for long-term investment. There are well established paths for institutional investors and high net worth individuals to invest in these projects. The path for Main Street investors, and particularly those who live in the Opportunity Zone itself, to invest in these projects is often more complex and could cause those raising funds to exclude, or significantly restrict participation by, Main Street investors.

The SEC has also proposed and adopted amendments that would simplify, harmonize, and improve the capital raising framework that Qualified Opportunity Funds currently use to invest in entrepreneurs. The proposed amendments have have been adopted.

×