ICYMI | Secretary Turner Recaps Major Wins from National Homeownership Month, Underscores Need for Rate Cuts

WASHINGTON - During National Homeownership Month, U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner spearheaded regulatory rollbacks and strategic initiatives to expand access to the American Dream of homeownership.

As Secretary Turner stated, “We’re slashing regulations at HUD to unleash the private sector to build and get government out of the way. The Federal Reserve needs to do its part and cut interest rates. Mortgage rates will follow.”

Secretary Turner kicked off National Homeownership Month by ringing the Closing Bell at the New York Stock Exchange. In his remarks, Secretary Turner spoke about the important role of free enterprise and market-driven solutions in expanding access to affordable housing, referencing former President Calvin Coolidge: “‘The chief business of America is business.’ And what better way to celebrate that than to be here at the New York Stock Exchange and there's no greater time to celebrate that than National Homeownership Month.”

Watch the Closing Bell ceremony here.

More Highlights from National Homeownership Month:

HUD Slashes Red Tape to Cut Homeownership Financing Costs | HUD.gov

Secretary Turner announced the Federal Housing Administration (FHA) is rescinding more than 12 sub-regulatory policies under its Single Family mortgage insurance program. These sweeping changes cut red tape, help reduce the cost of homeownership, and eliminate financial and regulatory burdens. The rescissions span the loan origination process from the point of mortgage application submission through FHA’s issuance of an insurance endorsement on the mortgage.

HUD Secretary Scott Turner Moves to Eliminate Green Housing Mandate | HUD.gov

Secretary Turner announced the Federal Housing Administration (FHA) will propose an across-the-board leveling of its Upfront Capitalized and Annual Mortgage Insurance Premiums (MIPs) to 25 basis points for all Multifamily program categories. This action is the first step in eliminating the ideologically motivated green energy category, which will lower costs for lenders and developers and will help accelerate the supply of affordable housing stock for the American people.

MBA Statement on HUD’s Proposal to Level FHA Multifamily Mortgage Insurance Premiums | MBA

“We commend HUD Secretary Scott Turner and his team for being responsive to our recommendations on this issue. Leveling upfront and annual mortgage insurance premiums will help increase rental housing production and improve affordability for renters across the country,” said MBA's President and CEO Bob Broeksmit.

“NAA and the undersigned organizations express their appreciation to the U.S. Department of Housing and Urban Development (HUD) for its recent policy changes to the 2025 Operating Cost Adjustment Factors (OCAFs), particularly the change to the insurance factor methodology to address rising property management insurance cost and insurance coverage challenges,” said the National Apartment Association and several undersigned organizations.

FHA hosted its first annual Manufactured Housing Lender Roundtable at HUD headquarters demonstrating how the agency is convening industry leaders and taking action to lower the cost of housing, expand supply, and cut red tape.

HUD, Ginnie Mae, and the Korea Housing Finance Corporation (KHFC) signed a memorandum of understanding (MOU) to strengthen international cooperation in housing finance. The MOU underscores a shared commitment to expanding access to affordable housing, cultivating innovation, and supporting residential development.

In the News:

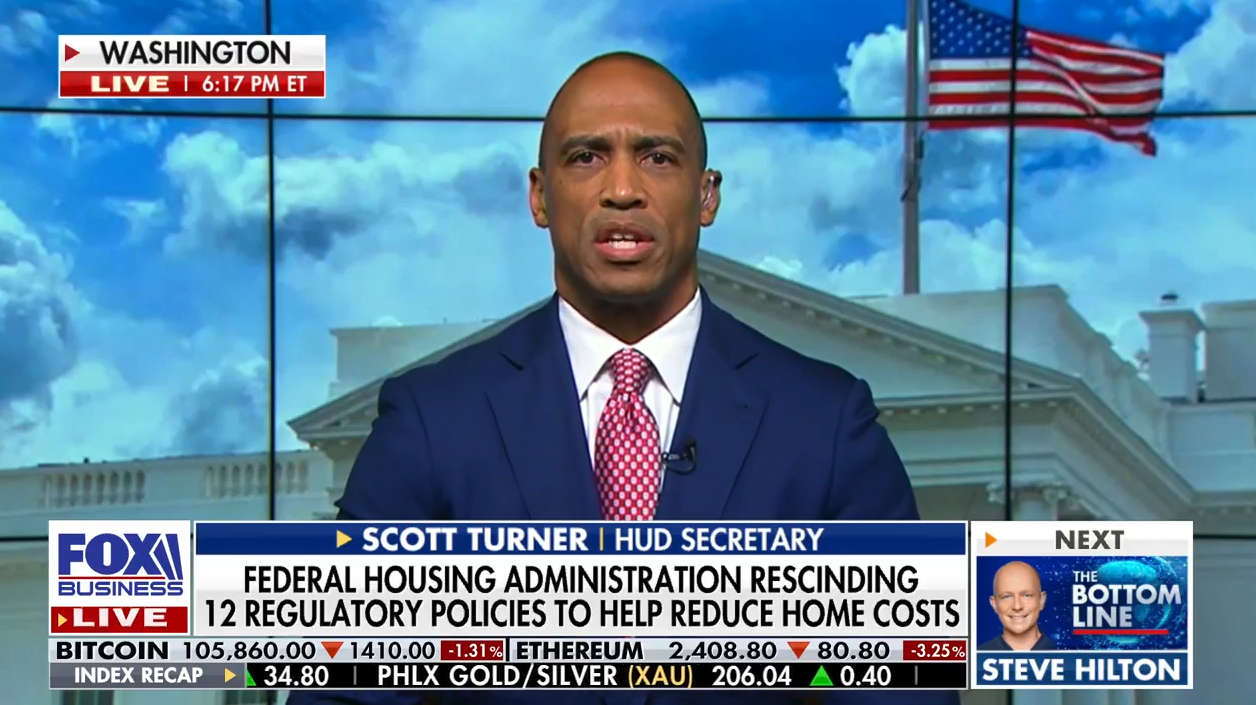

HUD Secretary Scott Turner on National Homeownership Month | Fox Business

Secretary Turner joined Dagen McDowell and David Webb on Fox Business to discuss National Homeownership Month: “Since President Trump took office, FHA has insured loans for 236,000 homebuyers, with 140,000 of those going to first-time homebuyers. We will continue to take down burdensome regulations to unleash the creativity of the private sector,” Secretary Turner told Dagen McDowell and David Webb.

HUD Working to Bring Down the Cost of Housing | Real America's Voice

Secretary Turner spoke with Jack Posobiec of Real America’s Voice to discuss how HUD is making housing affordable again for first-time homebuyers: “We’ve been taking down burdensome regulations not only from the federal standpoint but also encouraging localities to take inventory of their regulations - what’s causing developers and builders not to be able to build affordable workforce housing in our country. Right now, we need about 7 million units of housing...we are hard at work to make sure that housing affordability comes down, the supply goes up, the cost comes down,” said Secretary Turner.

HUD Secretary Scott Turner on The Bottom Line | Fox Business

Secretary Turner spoke with Dagen McDowell and Jason Chaffetz on Fox Business on cutting regulations to help American homebuyers: “We have taken down burdensome regulations...with our FHA program from the point of application all the way until the endorsement of the issuance of the mortgage. We took down twelve steps to make it better,” Secretary Turner told Dagen McDowell and Jason Chaffetz.

Modernizing the path to homeownership in Indian Country | Tribal Business News

Secretary Turner penned an opinion editorial on HUD’s commitment to expanding access to homeownership opportunities for Indian Country: “A home anchors families and strengthens communities—and HUD’s Section 184 Indian Home Loan Guarantee Program helps tribal communities build these foundational roots through access to the financial tools needed for homeownership,” said Secretary Turner.

Secretary Scott Turner: How HUD is celebrating National Homeownership Month | The Post Millennial

Secretary Turner penned an opinion editorial on unlocking homeownership opportunities for the next generation of Americans: “This National Homeownership Month, we celebrate not only the dream of owning a home—but also the efforts being made to make that dream attainable, especially for young Americans. With the right policies in place, more millennials can become homeowners and help shape the future of communities nationwide for generations to come,” said Secretary Turner.

Read More…

Secretary Reaffirms HUD Commitments During National Homeownership Month | The MortgagePoint

“Secretary Scott Turner of the U.S. Department of Housing and Urban Development (HUD) proclaimed June to be National Homeownership Month, highlighting HUD’s role in bringing back the American Dream of homeownership and honoring the ability of homeownership to strengthen communities.”

HUD plans overhaul of its manufactured housing program | National Mortgage News

“The Department of Housing and Urban Development is weighing a number of changes to its manufactured housing program as it looks to it as a key solution to addressing the nation's housing shortage quickly.”

HUD rescinds several regulatory requirements for FHA-backed mortgages | ABA Banking Journal

“In a move intended to reduce the cost of homeownership and eliminate unnecessary burden, the Department of Housing and Urban Development on Friday rescinded more than a dozen regulatory requirements in the Federal Housing Administration’s single-family mortgage insurance program.”

HUD backs off green housing requirements | E&E News by POLITICO

“In conjunction with the Federal Housing Administration, the department plans to level its annual mortgage insurance premiums to 0.25 percent across all multifamily program categories, effectively eliminating incentives for “green building” requirements that Turner called “ideologically motivated.”

Follow @SecretaryTurner on X, FB, and Instagram.